Therefore, if the discount is allowed, the receiver receives a lesser amount than the amount due, and the payer pays less amount than what is actually due to him. Hence, it is a loss to the one receiving payment but a gain to the person paying it. We record the revenue only the net amount which equals to gross price less discounted amount.

Company ABC manufactures the cloth and sells it to both the whole seller and consumers. The company provides a trade discount of 20% to the wholesaler who purchases more than 1,000 units per order. During January, one wholesaler order 5,000 units of cloth at $5 per unit.

Welcome to Accounting Education

It is mainly provided to increase the volume of sales attained by a supplier. The total amount the wholesaler will pay the manufacturer is $680,000 after a discount of $120,000 on $800,000. Emilie to calculate sum of year digits depreciation is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from large corporates and banks, as well as fast-growing start-ups.

- If a firm is privileged to enjoy the two types of discounts, namely trade discount and cash discount, then the accounting treatment is as detailed in the example below.

- It is mainly provided to increase the volume of sales attained by a supplier.

- This means that the company can deduct $280 (1% of $28,000) if it pays the invoice within 10 days.

- The primary differences between the two come from the following points.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Twin Brother co ltd gave Pauline a trade discount of 10% for she is a business woman and had bought goods in large quantities. Trade discounts prompts the business to continue generating more cash which makes it possible to meet debts as and when they fall due. This minimizes chances of being put under liquidation by third parties.

A trade discount is a reduction in the selling price of goods or services a supplier provides to its customers. The process involves negotiating the terms of this reduction, establishing a list price, applying the discount to calculate the discounted price, and reflecting the discount on the invoice. Trade discounts help incentivize customer purchases, reward loyalty, promote bulk orders, and establish favourable pricing arrangements.

Accounting for Trade Discounts

This discount occurs before a company calculates the amount payable by the customer. Accounting standards do not require a separate treatment or disclosure on the financial statements for this discount. It differs from a cash discount which companies offer to encourage early settlements. The supplier and customer negotiate the discount rate or amount, eligibility criteria, and specific goods or services covered. The supplier sets a list price, serving as the original selling price.

In the books of the buyer, it is recorded as «Purchase Discount» if the periodic inventory method is used of a deduction to inventory when under the periodic method. Suzan bought 100 scarfs, from Kim for Rs. 500 each, subject to Trade Discount @ 15%. This means that an additional 5% cash discount will be allowed to Suzan if she makes payment within 30 days. It means the company will provide a cash discount of 2% over the invoice amount if the customer pays within 10 days from the invoice date. This step entails adding up all the bits of trade discounts from all the bands provided by the wholesaler/manufacturer. It is a discount allowed at the time of making payments or receipts of cash.

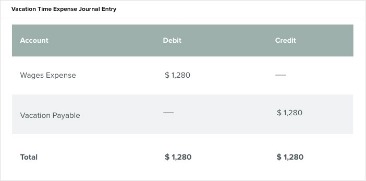

The entry shown in the article is for purchase after adjustment. The discount received will then appear on the Income Statement as one of the Other Income items. The discount allowed will then appear on the Income Statement as one of the expense items. Cash discount is an expense for the seller and income for the buyer. It is, therefore, debited in the books of the seller and credited in the books of the buyer. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

Calculate the discount if the buyer buys products worth $500 and pays within 7 days. Giving these discounts builds good business relationships between buyers and sellers. As none of the parties record this discount anywhere in the books of accounts, the discount amount largely depends on the parties’ mutual understanding and business relations. Market forces of a competitive environment in the industry might also be a factor in deciding the discount rate.

Would you prefer to work with a financial professional remotely or in-person?

There will be no entry for the amount of discount granted by the manufacturer to a wholesaler in the books of accounts of both parties. The list price is generally present in the catalog of the manufacturer. Moreover, the manufacturer gives this discount usually when the buyer purchases the product in bulk.

Integrated aquatic and terrestrial food production enhances … – Nature.com

Integrated aquatic and terrestrial food production enhances ….

Posted: Mon, 04 Sep 2023 15:46:36 GMT [source]

This type of discount is usually granted on the list price of the products by the supplier or wholesaler to the retailer for considerations such as buying goods in bulk, trade relations, etc. It is always allowed as certain percentage on sale price i.e., invoice price. The trade discount is not normally recorded in the books of account. In other words, only the net amount of purchase or sale i.e., invoice price minus trade discount is recorded in the journal.

Step 1 of 3

Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from corporates, financial services firms – and fast growing start-ups. Purchases in the books of the buyer is also recorded at net of the trade discount. The term ‘discount’ refers to the deduction at a specified rate from the total amount receivable or payable based on the terms of the agreement.

- Cash discount will have an impact on journal entries of the company when the customer eligible for the discount.

- For instance, let’s assume that a company purchases goods and the supplier’s sales invoice is $28,000 with terms of 1/10, net 30.

- Company ABC manufactures the cloth and sells it to both the whole seller and consumers.

- For example, credit customers are usually given 30 days after they receive the invoice to make payment.

- This minimizes chances of being put under liquidation by third parties.

- The percentage of cash discount is mentioned in the payment terms.

A cash discount is a deduction off the invoiced amount given to credit customers, with the sole purpose of encouraging them to make prompt payment (pay faster). The supplier will be the one who decides on the number of days which the cash discount is valid for. For example, credit customers are usually given 30 days after they receive the invoice to make payment. If they pay within 7 days of the invoice date, they will receive a 5% off the invoiced amount. John’s Sports Apparels and Becky’s Cafe are both given trade discounts by the business. The list price (full amount) and the discounts are not recognized.

Trade Discount Accounting

It is generally recorded in the purchases or sales book, but it is not entered into ledger accounts and there is no separate journal entry. However, here is an example demonstrating how a purchase is accounted in case of trade discount. As mentioned in Trade Discount vs. Cash Discount — Part 1 , cash discounts are offered by suppliers to encourage prompt payments/early settlements by customers. From a supplier’s point of view, the quicker he can get his money back, the less likely his customer will default on payment. Trade discounts help incentivize bulk purchases or establish long-term relationships, while cash discounts encourage prompt payment and improve cash flow for the seller.

Suppose James purchased goods from Ali of the list price of Rs. 50,000, on July 1, 2021. Ali allowed a 10% discount to James on the list price, for purchasing goods in bulk quantity. Further, a discount of Rs. 2000 was allowed to him, for making the payment within 30 days.

And this net amount (net sales price) is recorded in the books of account. Further, a trade discount is offered in case of both cash sales and credit sales. So, when there are cash sales, it is deducted from the cash memo, whereas in the case of credit sales, the amount of discount is deducted from the sales invoice. Company ABC sells goods for $ 50,000 to the customer on credit. In order to encourage customer payment, the company offers a term payment of 5% 10/Net 30. It will provide 5% cash discount on early payment within 10 days.

When the customer completes a purchase, the trade discount gets applied, resulting in a reduced selling price. The customer receives an invoice that reflects the discounted price, and payment occurs based on that amount. Even though trade discounts can be recorded in the daily purchase and sales books for bookkeeping needs, there is no separate journal entry made into the general ledger for accounting purposes. Once the discount is charged, the net amount which the customer has to pay is determined.

Comentarios recientes